Credit: www.reddit.com

Introduction

Golf carts are fun and useful. Many people use them on golf courses. Some use them in communities or big properties. But, golf carts need insurance. Let’s talk about the cost to insure a golf cart.

Why Do You Need Golf Cart Insurance?

Accidents can happen. Someone can get hurt. Property can get damaged. Insurance helps cover these costs. It protects you from big expenses. So, it’s important to have insurance for your golf cart.

Factors That Affect Golf Cart Insurance Cost

Many factors affect the cost. Here are some key points:

- Type of Golf Cart: Newer carts cost more to insure. Older carts cost less.

- Usage: Using your cart on public roads increases the cost. Limited use on a golf course may be cheaper.

- Coverage Amount: Higher coverage costs more. Lower coverage costs less.

- Location: Some places have higher insurance rates. Others have lower rates.

- Driver’s Age: Younger drivers may pay more. Older drivers may pay less.

- Driving Record: A clean record can lower costs. A bad record can raise costs.

Types of Golf Cart Insurance Coverage

Different types of coverage are available. Let’s look at them:

- Liability Insurance: Covers damage to others. This includes injury and property damage.

- Collision Insurance: Covers damage to your golf cart. This is from an accident with another vehicle or object.

- Comprehensive Insurance: Covers non-collision damage. This includes theft, fire, or vandalism.

- Uninsured Motorist Coverage: Covers your costs if the other driver has no insurance.

- Medical Payments Coverage: Covers medical bills for you and passengers.

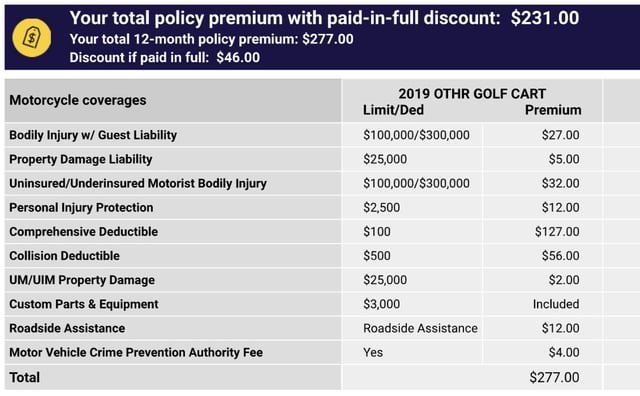

Average Cost of Golf Cart Insurance

So, how much does it cost? On average, basic insurance costs between $75 and $150 per year. Full coverage can cost between $200 and $400 per year. These are just averages. Your cost may be higher or lower.

Ways to Save on Golf Cart Insurance

Want to save money? Here are some tips:

- Shop Around: Get quotes from different companies. Compare prices and coverage.

- Bundle Policies: Combine your golf cart insurance with other policies. This can lower the cost.

- Increase Deductibles: Higher deductibles can lower your premium. But, you pay more if you have a claim.

- Maintain a Clean Record: Drive safely. Avoid accidents and tickets.

- Ask for Discounts: Some companies offer discounts. Ask about them.

Credit: eveins.com

Frequently Asked Questions

How Much Does Golf Cart Insurance Cost?

The cost varies. Typically, it’s $75 to $150 per year.

What Factors Affect Golf Cart Insurance Rates?

Factors include cart type, usage, location, and your driving record.

Is Golf Cart Insurance Mandatory?

It depends on your state laws and where you drive.

Can I Add My Golf Cart To My Auto Insurance?

Yes, some auto insurers offer golf cart coverage.

Conclusion

Golf cart insurance is important. It protects you from big expenses. The cost depends on many factors. Shop around and compare prices. Look for ways to save money. Stay safe and enjoy your golf cart!

Leave a Reply